US prosecutors plan to seek a guilty plea from Boeing about misleading safety regulators about the development of the 737 Max, which was involved in two fatal crashes. While the nearly six-year-old controversy might be nearing some sort of closure with the plea, a lawyer representing victims of the two crashes fears the aircraft manufacturing giant would get away lightly with a “sweetheart” deal.

For context, Boeing’s recent troubles began when two new 737 Max jets crashed in quick succession, just a few months apart, between 2018 and 2019, in Indonesia and Ethiopia, leading to 346 deaths. After the first crash, Boeing allowed 737 Max planes to fly again even though it didn’t know what caused it, directly leading to a second tragic crash.

After the second incident, the aircraft was grounded globally for 20 months. Boeing eventually reached a $2.5 billion deferred prosecution agreement with the Department of Justice (DOJ) to avoid prosecution on a single charge of fraud. While the settlement shielded Boeing from prosecution, it did not grant any immunity to employees who were found to be negligent and engaged in any misconduct (but it hasn’t gone after employees or executives yet, either).

Boeing Aircraft Continue to be Involved in Safety-Related Incidents

Earlier this year, the door panel of a 737 Max jet blew off during an Alaska Airlines flight. In a more recent incident, the engine cover on a Southwest Airlines Boeing 737-800 fell off during takeoff in April.

In May, the DOJ said that Boeing breached the terms of its 2021 agreement that shielded it from criminal charges and was liable for prosecution.

While it hasn’t had any other high-profile crashes on its watch yet, Boeing has been drowning in problems from whistleblower testimony to harsh congressional hearings. Last month’s testimony of Boeing’s CEO Dave Calhoun was a disaster, and lawmakers blamed him and the company’s C-suite for Boeing’s safety woes.

To improve its safety compliance, Boeing agreed to buy Spirit AeroSystems for $4.7 billion. The company, which Boeing had spun off in 2005, was responsible for fitting the 737 Max plane during an Alaska Airlines flight whose door panel blew off earlier this year.

US Pushing for a Guilty Plea for DOJ

Reportedly, US prosecutors are planning to ask Boeing to plead guilty and the company would have until the end of the week to accept the plea, or else fight a fraud-conspiracy case. As part of its guilty plea, Boeing would need to pay an additional penalty of $243 million and would also have to agree to hire a third-party consultant to monitor its safety compliance.

Meanwhile, the families of the victims of two fatal 737 Max crashes are not happy with the plea deal. As is quite evident, Boeing would get away with easily in what Attorney Paul Cassell, who represents the victims’ families, describes as a “sweetheart plea deal.”

He said that “the memory of 346 innocents killed by Boeing demands more justice than this,” and families of the victims would object to the plea deal. Indeed, it’s hard to imagine that if some other less important company or group negligently caused the deaths of over 300 people, its executives would avoid charges entirely.

Notably, a letter that Cassell sent to the DOJ last month, said that the families sought prosecution of Boeing’s top executives and a fine of $24.8 billion for “the deadliest corporate crime in US history.”

There are also concerns over the legal process being followed in this case. Notably, Boeing was a client for Lisa Monaco, the deputy attorney general at the DOJ, who had Boeing as a client while working at WestExec Advisors. David Sirota, a top journalist at TheLever, pointed out that she is the one to decide whether Boeing will be prosecuted here, so it would be rather suspect if Boeing gets another sweetheart deal. If that wasn’t enough, that consulting firm was co-founded by current US Secretary of State Antony Blinken.

Prosecutors have reportedly recommended criminal charges against Boeing.

The decision on whether or not to prosecute is overseen by Deputy AG Lisa Monaco, who was a Boeing consultant & who’s kept corporate prosecutions near a record low.

Let it sink in.https://t.co/aumeYApA2h pic.twitter.com/D2ATdXpS7r

— David Sirota (@davidsirota) June 25, 2024

What Would a Guilty Plea Mean for Boeing Stock?

So far, Boeing has evaded any guilt on its part which means that officially it hasn’t admitted any wrongdoing on its behalf. A guilty plea could complicate the picture for Boeing’s already diminished brand. Also, the company might be barred or suspended from being a US defense contractor (though that seems unlikely, given how important it is in the defense industry).

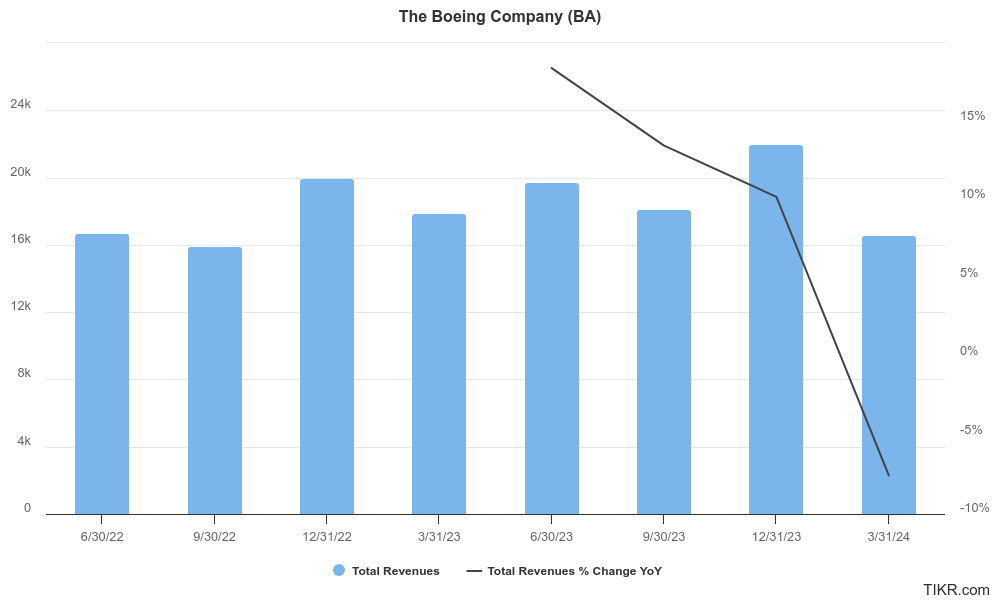

Boeing’s Defense, Space and Security segment has been a key driver of its revenue growth, and in Q1 2024, the business generated revenues of nearly $7 billion, which was even higher than the $4.65 billion that it generated from selling commercial aircraft. While arguably, its commercial sales have sagged due to tepid deliveries as it prioritized safety over volumes after the multiple incidents, the segment’s importance to Boeing’s earnings cannot be overstated.

Aircraft Manufacturing Industry’s Duopoly Could Save the Day for BA

Meanwhile, Boeing stock is trading in the red today even as the broader markets are in the green. The aircraft manufacturing industry is indeed a duopoly which is making some analysts see Boeing in a more positive light, despite its many troubles.

Notably, Chinese state-owned plane maker COMAC is also trying to expand internationally. While COMAC is arguably an untested player for global airlines and not many Western airlines might order from them at least in the near term, Boeing does not have any laurels to its name either when it comes to credibility – or at least that’s what the general perception has been about the brand over the last couple of years.

Overall, it looks like the aircraft manufacturing industry’s duopoly could just save the day for Boeing as the company’s business would have been otherwise hampered it was in a competitive industry.

However, a guilty plea could still derail its defense business – both in the US and globally – as lawmakers would question spending big dollars on buying its aircraft, which haven’t been the shining example of safety.