Chinese discount shopping websites like Temu and Shein have grown increasingly popular among US consumers due to the low-priced discounted goods that are sold on their platforms. US ecommerce giant Amazon is also planning a similar discount shopping service as it tries to prevent an erosion of its customer base compared to its agile rivals.

To begin with, the business model of Shein and Temu revolves around the “de minimis” provision of Section 321 of the Tariff Act of 1930, which waives import tariffs if the value of imported shipment does not exceed $800. These companies ship products directly from suppliers -predominantly in China – directly to the consumers, avoiding tariffs entirely.

As a result, they carry very little inventory in the US, and while they can’t match the kind of delivery speed that Amazon promises they more than offset it with cheaper prices. The proposition is quite attractive for many users who can wait for products like apparel and fashion accessories while paying a much lower price.

Temu and Shein Have Grown Spectacularly

Temu and Shein have grown spectacularly over the last couple of years. In fact, according to Sensor Tower Temu is the most downloaded free app on Apple App Store today while Shein is at the fifth position.

Things are no different on Google Play Store and Temu is the most downloaded app while Shein is at the sixth position. Temu which is owned by Chinese tech giant PDD has over 50 million monthly active users in the US. Shein on the other hand has 17.3 million active users in the country. You can check the video above to learn more about how Shein achieved explosive growth.

To be sure, in absolute terms, Amazon has a much bigger user base in the US and has around 180 million Prime subscribers in the country. However, while both Temu and Shein have grown incredibly well in the US, Amazon’s growth has sagged.

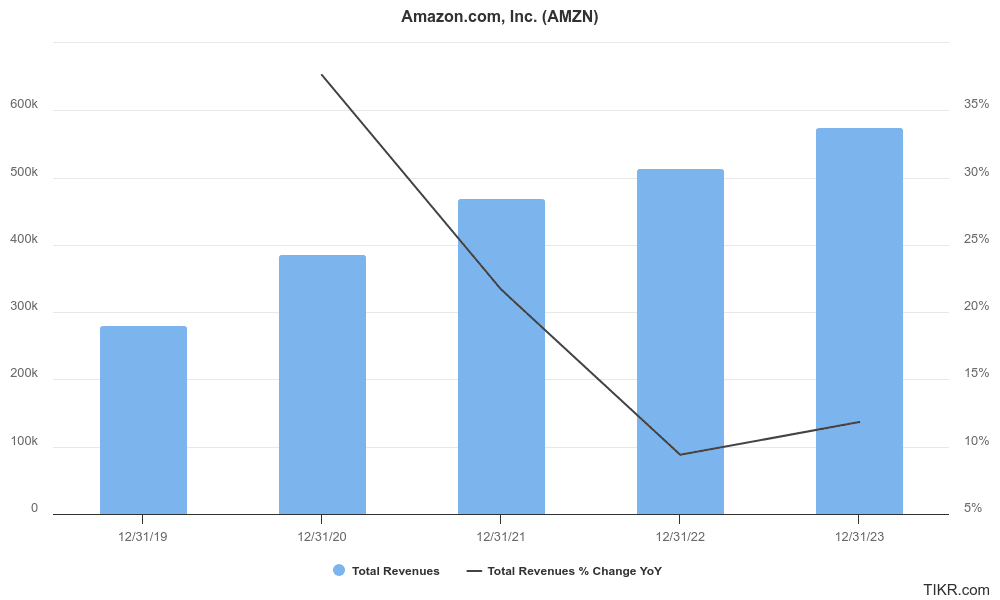

Amazon’s North American sales increased 12% in 2023 and 13% in 2022 which is much below what we saw in the previous years. To be sure, US ecommerce sales growth has tapered down following the bump between 2020 and 2021, and given Amazon’s higher base, it is logical that its growth would slow down. However, the slowdown also coincides with the rapid growth that Temu and Shein have witnessed.

How Would Amazon’s Discount Store Look Like?

Meanwhile, Amazon also wants a piece of the fast-growing discount shopping market in the US after having conquered the ecommerce landscape in the country. A Wall Street Journal report said that last week Amazon held its invite-only meeting with Chinese merchants to brief them about the plan. Citing the slide presentation, the report said, Amazon “unveiled a plan to debut a new channel on its platform to sell unbranded fashion wear and household products from China.”

According to Wang Xin, executive chairwoman of the Shenzhen Cross-Border Ecommerce Association, “The initial feedback from Chinese merchants has been quite positive even though Amazon has yet to officially launch the new programme.”

While the platform might resemble the likes of Temu, according to Wang, unlike Temu, sellers would be able to set their own prices on Amazon’s discount platform.

Logistically though, it could be different from how Amazon manages its supply chain. Instead of routing the products from its warehouses, Amazon would ship the product directly from the supplier to the buyer within nine to 11 days after the order is placed.

So far Amazon hasn’t said anything officially about its discount store and a spokesperson told the Wall Street Journal that it is “always exploring new ways to work with our selling partners.”

Amazon could leverage the huge data that it has about users’ buying preferences and use it in conjunction with its artificial intelligence (AI) capabilities to come up with a compelling discount platform for buyers.

Could the US target Chinese ecommerce Companies Next?

With its discount store, Amazon might also want to capitalize on the growing regulatory heat over Chinese tech companies doing business in the US. President Joe Biden has passed a law that could ban TikTok in the US unless its parent, ByteDance, divests its stake. While TikTok has contested the law judicially, among others on grounds of the First Amendment, the growing animosity between the world’s two biggest economies is only set to increase.

To be sure, there are genuine concerns over TikTok or, for that matter, other Chinese tech companies being a security threat as, according to Chinese law, they could be forced to assist in national intelligence efforts, likely including sending US user data to the government.

Both Shein and Temu are facing regulatory scrutiny in the US, albeit not on TikTok’s scale. Firstly, many lawmakers allege that these companies evade tariffs by exploiting the de minimis rule. Then there are concerns over their suppliers employing forced labor in China.

A 2023 report by the US-China Economic and Security Review Commission also highlighted Shein’s data collection policies and said, “the company’s app also requests that users share their data and activity from other apps, including social media, in exchange for discounts and special deals on Shein products.”

.@USCC_GOV report: “Shein’s app requests that users share their data and activity from other apps, including social media, in exchange for discounts and special deals on Shein products” h/t @jacobhelberg https://t.co/BCxso6i3Sq

— Martijn Rasser (@MartijnRasser) April 16, 2023

Discount Store Could Help Amazon Increase its Revenues

The report added that Shein has “struggled to protect user data.” More recently, in December the House Committee on Energy and Commerce sent Shein a letter that sought its response on the company’s data collection policies as well as its relationship with the Chinese government. Incidentally, a similar letter was sent to TikTok which now faces prospects of getting banned in the US.

Shein was looking to list in the US but that now seems to have been put in cold storage given the regulatory scrutiny and the company is now reportedly considering a London listing. Meanwhile, if the US cracks down on companies like Shein and Temu, it could be an advantage for the likes of Amazon. To add, if the company’s discount platform gains traction it could take some market share from the incumbents.

Chinese fast-fashion giant Shein is planning for an IPO in London.

Valued at $66 billion, Shein will be the second largest IPO in the history of UK stock market.

Shein wanted to do a NY IPO, but anti-China hysteria sabotaged that.

But no worries, US companies like Goldman… pic.twitter.com/CgOz7gEOox

— S.L. Kanthan (@Kanthan2030) June 2, 2024

While Shein hasn’t publicly revealed its financials, we learned a lot from Jamie Salter, the founder of brand management firm Authentic Brands Group, whose company partnered with Shein. He believes the company’s revenues are “a lot more” than $30 billion that it was estimated to rake in every year. To sum it up, discount shopping could be a growth driver for Amazon, especially at a time when the growth in its US ecommerce segment has tapered down.

The pivot to discount shopping might not be that easy for Amazon though and it would also need to protect its brand. According to Zhang Yi, founder, and chief analyst at market consultancy iiMedia, “Amazon has set its sights on China as an enormous and highly efficient manufacturing hub to provide a variety of cheap goods, but it remains to be seen whether the company can make a smooth shift from its existing model to a low-cost one.”